Will My Estate be Subject to Death Taxes?

Even if you believe that you may not be affected by the federal estate tax, you still need to determine whether you may be subject to state estate and inheritance taxes. Further, you may have a taxable estate in the future as your assets appreciate in value. You should regularly review your estate plan with an estate planning attorney to ensure your estate plan takes into account changes in the tax laws as well as shifts in your individual circumstances.

Will a Revocable Living Trust Help Reduce Estate Taxes?

The Four Must-Have Documents to Include in Your Estate Plan

Unless you have limited assets and can get by with a simple will, you need an estate plan that includes several documents to ensure that your assets are distributed the way you desire, and your other wishes are fulfilled, all with minimal court intervention.

Unless you have limited assets and can get by with a simple will, you need an estate plan that includes several documents to ensure that your assets are distributed the way you desire, and your other wishes are fulfilled, all with minimal court intervention.

What Happens If I Die Without A Will?

Unfortunately, many young people, and even some of us more mature folks, don’t want to think about our eventual death and fail to do estate planning. If you neglect having a will prepared and pass away without an estate plan, interstate succession laws will come into play.

Unfortunately, many young people, and even some of us more mature folks, don’t want to think about our eventual death and fail to do estate planning. If you neglect having a will prepared and pass away without an estate plan, interstate succession laws will come into play.

Should I Get a Revocable Trust?

For many estate plans, a revocable trust, rather than a simple will, is usually recommended if you own property or significant assets. A will may be satisfactory for smaller estates. But a properly drafted revocable trust can accomplish many estate goals.

For many estate plans, a revocable trust, rather than a simple will, is usually recommended if you own property or significant assets. A will may be satisfactory for smaller estates. But a properly drafted revocable trust can accomplish many estate goals.

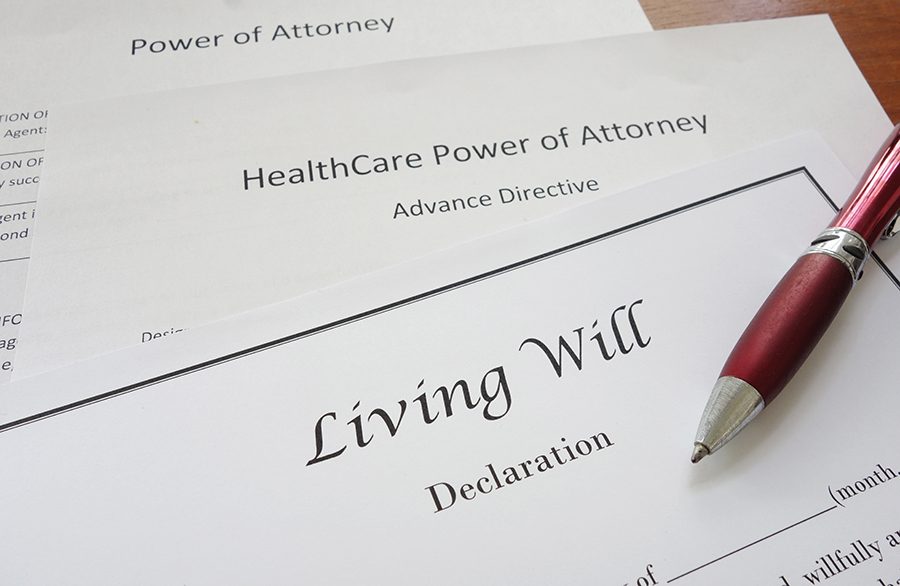

The Importance of Having a Living Will

No one wants to believe that we may not be able to make our own decisions about our health and medical care. But if misfortune strikes and you become too ill or incapacitated to assist in your own care, it is important to have a Living Will prepared and in place.

Your Auto Insurance Will Skyrocket If You Get A DUI

Utah is tough with vehicle insurance after DUI’s

Utah is tough with vehicle insurance after DUI’s

Our State is considered one of the toughest of all when it comes to DUI convictions and vehicle insurance requirements. In fact, following a conviction in the State, the dreaded SR-22 auto insurance is mandatory for a period of three years.

The Basics of Living Trusts

Many people mistakenly believe that wills do not have to go through the probate. This is not true! In fact, the best way to avoid the arduous probate process is to make a living (or inter-vivos) trust. These trusts can be created in conjunction with a will, or as an alternative to one. Creating a living trust will save time, money, and the hassle of dealing with probate hearings. Here, we'll look at the basic aspects of living trusts.

Why You Might Need a Living Will

Living wills are a different creature than the traditional notion of a will. These devices are sometimes referred to as advance health care directives. Their main purpose is to instruct what type of care a person should receive during incapacitation. Clearly, this contrasts with a traditional will's purpose of distributing assets after death. Many people use the two devices together as part of a comprehensive estate plan. This article will explain why you might need a living will as part of your end of life law plan.

How Will Trump’s Healthcare Executive Order Affect Utahns

On October 12, President Donald Trump signed an executive order titled “Promoting Healthcare Choice and Competition Across the United States” that he believes will “fix” a broken healthcare system caused by the Affordable Health Care Act, aka Obamacare.

Businesses will Get a Boost by a Robust Economy in Utah

Consumer hopes to make even more income and find better jobs next spring are higher than ever. This will be a big shot in the arm toward continuing to boost an already robust economy in Utah.

Which Parties Can Contest a Will?

Any estate lawyer will tell you that not just anyone can challenge a valid will. When it comes to the law governing wills (in most states) only interested persons may submit a challenge.

The State Will Be Asked for More Support for Juvenile Early Intervention

A legislative bill that was passed earlier during the year was a welcomed source of help to both the juvenile justice system and the school board in Utah.

Will I Lose My Tax Refund by Filing for Bankruptcy?

It is no secret that filing for bankruptcy will cause you to lose some of your assets. These assets are taken by the bankruptcy trustee to pay off debts owed. Unprotected assets, such as a tax refund, are susceptible to becoming part of the bankruptcy estate.

Legal Planning for the Elders in Your Life

Are you worried about what might happen to your parents as they age? Elders are, sadly, often targeted for money-making scams. There are plenty of people who want to take care of their cognitive decline.

Wills and Trusts Are Good Estate Planning Tools Regardless of Net Worth

At every stage of life, estate planning plays an important role in providing for your family after death and managing your assets while you are living.

Things You Don't Need in Your Will

If you are considering creating a will, you've likely spent a long time planning it out. This is completely normal. A will is your final chance to distribute your cherished belongings to your loved ones.

What Happens When Someone Dies Without Heirs

Whenever someone dies without a will, the rules of intestate succession take over. Nearly every jurisdiction uses these rules to try to emulate what would happen if a will did exist. In most cases, the property owned by the decedent flows down to any of his or her surviving heirs.

Do You Need a Living Will?

Wills are often associated with the process that occurs after a person passes. Many people are not aware that they can create a will that dictates what happens before their final day. Living wills, sometimes called Advance Health Care Directives, help you plan for your own care.